UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

FISERV, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

255 Fiserv Drive

Brookfield, Wisconsin 53045

April 8, 2009

To Our Shareholders:12, 2012

You are cordially invited to attend the annual meeting of shareholders of Fiserv, Inc., to be held at our corporate offices in Brookfield, WI on Wednesday, May 23, 2012 at 10:00 a.m. local timeThis is an important day on Wednesday, May 20, 2009. the Fiserv calendar, as it is an opportunity to review our financial results and strategic progress in providing our clients, and their customers, innovative technology products and services.

Information about the meeting and the matters on which shareholders will act is set forth in the accompanying Notice of Meeting and Proxy Statement. Following action on these matters, managementwe will present a report on our business activities. At the meeting, we willWe welcome your comments on or inquiries about our business that would be of general interest to shareholders generally. At your earliest convenience, please review the information on the business to come beforeduring the meeting.

It is very important thatWe urge you to be represented at the annual meeting, regardless of the number of shares you own or whether you are able to attend the annual meeting in person. Whether or not you plan to attend the meeting, please voteperson, by voting as soon as possible. Shareholders can vote their shares via the Internet or telephone using the instructions set forth on the enclosed proxy card. You canalso may vote your shares by marking your votevotes on yourthe enclosed proxy card, signing and dating it, and returningmailing it promptly in the enclosed envelope, which requires no postage if mailed in the United States. You may also vote your shares by using the Internet or a toll free telephone number. Instructions for these convenient voting methods are set forth on your proxy card. Voting by proxy will not prevent you from voting in person, and will ensure that your vote is counted if you are unable to attend.

Thank you for your prompt attention to this matter.envelope.

Sincerely,

Jeffery W. Yabuki

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 20, 200923, 2012

To the Shareholders of Fiserv, Inc.:

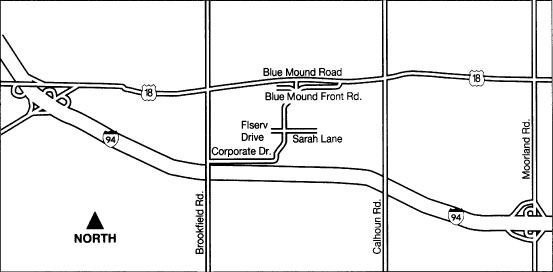

The annual meeting of shareholders of Fiserv, Inc. will be held at our corporate offices at 255 Fiserv Drive, Brookfield, Wisconsin 53045, on Wednesday, May 20, 2009,23, 2012, at 10:00 a.m. local time for the following purposes, which are set forth more completely in the accompanying proxy statement:

| 1. | To elect |

| 2. | To approve an amendment to our articles of incorporation that would eliminate the |

| 3. | To approve performance goals and related matters under the Fiserv, Inc. |

| To approve, on an advisory basis, the compensation of our named executive officers. |

| 5. | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for |

| To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof. |

The board of directors has fixed the close of business on March 27, 200928, 2012 as the record date for determining shareholders entitled to notice of, and to vote at, the annual meeting and at any adjournments or postponements thereof.

In the event there are not sufficient votes for a quorum or to approve any of the foregoing proposals at the time of the annual meeting, the annual meeting may be adjourned or postponed in order to permit our further solicitation of proxies.

By order of the board of directors,

Charles W. Sprague

Secretary

April 8, 200912, 2012

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on May 20, 2009:23, 2012: The proxy statement and annual report to security holders are available at

http://www.proxyvote.com.

Your vote is important. Our proxy statement is included with this notice. To vote your shares, please mark, sign, date and return your proxy card or vote by Internet or telephone as soon as possible. A return envelope is enclosed for your convenience if you vote by mail.

PROXY STATEMENT

Annual Meeting

This proxy statement is furnished in connection with the solicitation on behalf of the board of directors of Fiserv, Inc., a Wisconsin corporation, of proxies for use at our annual meeting of shareholders, to be held on Wednesday, May 20, 200923, 2012 at 10:00 a.m. local time, or at any adjournment or postponement of the meeting. At the meeting, we will vote on the matters described in this proxy statement and in the accompanying notice. The annual meeting will be held at our corporate offices at 255 Fiserv Drive, Brookfield, Wisconsin 53045. If you need directions or have any other questions about attending the meeting, please call (262) 879-5000. We intend to mail this proxy statement and accompanying proxy card on or about April 8, 200912, 2012 to all shareholders entitled to vote at the annual meeting.

Purposes of Annual Meeting

The annual meeting has been called for the purposes of: electing threetwo directors to serve for a three-year term expiring in 2012;2015; approving an amendment to our articles of incorporation that would eliminate the classified structure of our board of directors and provide for the annual election of directors as set forth in the amendment; approving the Amendedperformance goals and Restatedrelated matters under the Fiserv, Inc. Employee Stock Purchase Plan;2007 Omnibus Incentive Plan (the “Incentive Plan”); approving, on an advisory basis, the compensation of our named executive officers; ratifying the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2009;2012; and transacting such other business as may properly come before the annual meeting or any adjournments or postponements thereof.

Solicitation of Proxies

We will pay the cost of soliciting proxies on behalf of the board of directors. In addition to the use of the mail, our directors, officers and other employees may solicit proxies by personal interview, telephone or electronic communication. None of them will receive any special compensation for these efforts. We have retained the services of Georgeson Inc. (“Georgeson”) to assist us to solicitin soliciting proxies. Georgeson may solicit proxies by personal interview, mail, telephone or electronic communications. We expect to pay Georgeson its customary fee, approximately $10,000, plus reasonable out-of-pocket expenses incurred in the process of soliciting proxies. We also have made arrangements with brokerage firms, banks, nominees and other fiduciaries to forward proxy materials to beneficial owners of shares. We will reimburse such record holders for the reasonable out-of-pocket expenses incurred by them in connection with forwarding proxy materials.

Proxies

You should complete and return the accompanying form of proxy regardless of whether you attend the annual meeting in person. You may revoke your proxy at any time before it is exercised by: giving our corporate Secretary written notice of revocation; giving our corporate Secretary a properly executed proxy of a later date; or attending the annual meeting and voting in person; provided that, if your shares are held of record by a broker, bank or other nominee, you must obtain a proxy issued in your name from the record holder. Written notices of revocation and other communications with respect to the revocation of proxies should be addressed to Charles W. Sprague, Executive Vice President, General Counsel Secretary and Chief Administrative Officer,Secretary, Fiserv, Inc., 255 Fiserv Drive, Brookfield, Wisconsin 53045.

The persons named as proxies in the accompanying proxy card have been selected by the board of directors and will vote shares represented by valid proxies. All shares represented by valid proxies received and not revoked before they are exercised will be voted in the manner specified in the proxies. If nothing is specified, the proxies will be votedvoted: in favor of the proposals and each of the board’s nominees for director.director; in favor of the amendment to our articles of incorporation that would provide for the annual election of directors as set forth in the amendment; in favor of the performance goals and related matters under the Incentive Plan; in favor of the compensation of our named executive officers as disclosed in this proxy statement; and in favor of the ratification of Deloitte & Touche LLP as our independent registered public

1

accounting firm. Our board of directors is unaware of any other matters that may be presented for action at our annual meeting. If other matters do properly come before the annual meeting or any adjournments or postponements thereof, it is intended that shares represented by proxies will be voted in the discretion of the proxy holders. Proxies solicited hereby will be returned to the board of directors and will be tabulated by an inspector of election, who will not be an employee or director of Fiserv, Inc., designated by the board of directors.

1

Record Date and Required Vote

The board of directors has fixed the close of business on March 27, 200928, 2012 as the record date for determining shareholders entitled to notice of, and to vote at, the annual meeting. On the record date, there were 155,412,884137,288,472 shares of common stock outstanding and entitled to vote, and we had no other classes of securities outstanding. All of these shares are to be voted as a single class, and each holder is entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. The presence, in person or by proxy, of at least a majority of the outstanding shares of common stock entitled to vote at the annual meeting will constitute a quorum for the transaction of business. SharesHolders of shares that abstain from voting or that are subject to a broker non-vote will be counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business. In the event there are not sufficient votes for a quorum or to approve any proposal at the time of the annual meeting, the annual meeting may be adjourned or postponed in order to permit the further solicitation of proxies.

Directors will be elected by a majority of votes cast at the annual meeting. A description of the majority voting provisions in our by-laws appears below under the heading “Election of Directors – Majority Voting.” For Proposaleach of Proposals 2, 3, 4 and Proposal 35 to be approved, the affirmative votenumber of a majority of the votes cast in person or by proxy at“for” the meeting is required.proposal must exceed the number of votes cast “against” the proposal. For each of these proposals, abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

Voting

Shareholders can appoint a proxy by: marking their vote on their proxy card, signing and dating it, and returning it promptly in the enclosed envelope, which requires no postage if mailed in the United States; calling a toll-free number in accordance with the instructions on their proxy card; or using the Internetvoting on-line in accordance with the instructions on their proxy card.

Shareholders who hold shares through a bank, broker or other record holder may vote by the methods that their bank or broker makes available, in which case the bank or broker will include instructions with this proxy statement. Shareholders voting via the Internet or by telephone will bear any costs associated with electronic or telephone access, such as usage charges from Internet access providers and telephone companies.

An individual who has a beneficial interest in shares of our common stock allocated to his or her account under the Fiserv, Inc. 401(k) savings plan may vote the shares of common stock allocated to his or her account. We will provide instructions to participants regarding how to vote his or her allocated shares.vote. If no direction is provided by the participant about how to vote his or her shares, the trustee of the Fiserv, Inc. 401(k) savings plan will vote the shares in the same manner and in the same proportion as the shares for which voting instructions are received from other participants, except that the trustee, in the exercise of its fiduciary duties, may determine that it must vote the shares in some other manner.

Recent Corporate Governance Developments

Our board of directors is committed to corporate governance “best practices” where the board of directors believes that the same are in the best interests of our shareholders. We have recently implemented, or are taking steps to implement, changes in our governance practices. Specifically, in February, our board of directors adopted amendments to remove the supermajority voting provisions contained in our by-laws. In addition, Proposal 2 in this proxy statement, if approved, would result in the declassification of our board of directors. We believe that these changes are consistent with the best practices that have been adopted by leading public companies and our shareholders’ expectations.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of February 27, 2009March 15, 2012 by:

each current director and director nominee;

each executive officer appearing in the Summary Compensation Table;

all directors and executive officers as a group; and

any person who is known by us to beneficially own more than 5% of the outstanding shares of our common stock based on our review of the reports regarding ownership filed with the Securities and Exchange Commission in accordance with Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 (the “Exchange Act”).

Name(1) | Number of Shares of Common Stock Beneficially Owned(2)(3)(4)(5)(6) | Percent of Class(7) | ||||||||||||

T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 | 11,968,667 | (8) | 7.7 | % | ||||||||||

Name and Address of Beneficial Owner(1) | Number of Shares of Common Stock Beneficially Owned(2) | Percent of Class(3) | ||||||||||||

BlackRock, Inc.(4) 40 East 52nd Street New York, New York 10022 | 7,134,839 | 5.2 | % | |||||||||||

FMR, LLC Edward C. Johnson 3d(5) 82 Devonshire Street Boston, Massachusetts 02109 | 8,048,612 | 5.8 | % | |||||||||||

T. Rowe Price Associates, Inc.(6) 100 E. Pratt Street Baltimore, Maryland 21202 | 10,268,922 | 7.5 | % | |||||||||||

The Vanguard Group, Inc.(7) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 7,880,488 | 5.7 | % | |||||||||||

Jeffery W. Yabuki | 513,555 | * | 1,188,647 | * | ||||||||||

Thomas J. Hirsch | 208,086 | * | ||||||||||||

Mark A. Ernst | 15,434 | * | ||||||||||||

Rahul Gupta | 26,861 | * | 102,736 | * | ||||||||||

Thomas J. Hirsch | 61,346 | * | ||||||||||||

Peter J. Kight | 116,512 | * | ||||||||||||

Thomas W. Warsop III | 26,595 | * | 99,980 | * | ||||||||||

Donald F. Dillon | 3,647,121 | 2.3 | % | 2,078,192 | 1.5 | % | ||||||||

Daniel P. Kearney | 55,205 | * | 46,087 | * | ||||||||||

Gerald J. Levy | 180,678 | * | ||||||||||||

Peter J. Kight(8) | 152,022 | * | ||||||||||||

Denis J. O’Leary | 7,417 | * | 24,570 | * | ||||||||||

Glenn M. Renwick | 29,392 | * | 52,274 | * | ||||||||||

Kim M. Robak | 22,361 | * | 39,567 | * | ||||||||||

Doyle R. Simons | 2,646 | * | 22,295 | * | ||||||||||

Thomas C. Wertheimer | 25,284 | * | 41,656 | * | ||||||||||

All directors and executive officers as a group (15 people) | 5,108,511 | 3.2 | % | |||||||||||

All directors and executive officers as a group (17 people) | 4,593,306 | 3.3 | % | |||||||||||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the address for each beneficial owner is care of Fiserv, Inc., 255 Fiserv Drive, Brookfield, |

| (2) | All information with respect to beneficial ownership is based upon filings made by the respective beneficial owners with the Securities and Exchange Commission or information provided to us by such beneficial owners. Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws. |

Includes stock options, which, as of March 15, 2012, were exercisable currently or within 60 days: Mr. Yabuki – 1,071,957; Mr. Hirsch – 187,209; Mr. Gupta – 86,700; Mr. Warsop – 80,729; Mr. Dillon

3

– 188,397; Mr. Kearney – 31,671; Mr. Kight – 83,152; Mr. O’Leary – 11,588; Mr. Renwick – 22,693; Ms. Robak – 29,998; Mr. Simons – 12,009; Mr. Wertheimer – 33,164; and all directors and executive officers as a group – 2,108,806.

Includes shares of restricted stock subject to vesting: Mr. Dillon – 151; Mr. Kearney – 151; Mr. Renwick – 151; Ms. Robak – 151; Mr. Simons – 125; Mr. Wertheimer – 151; and all directors and executive officers as a group – 880. The holders of the restricted stock have sole voting power, but no dispositive power, with respect to such shares.

Includes shares deferred under vested restricted stock units: Mr. Hirsch – 4,976; Mr. Kearney – 3,920; Mr. Kight – 4,612; Mr. O’Leary – 3,134; Mr. Renwick – 3,920; Ms. Robak – 1,822; Mr. Simons – 3,920; and all directors and executive officers as a group – 26,304.

Includes shares eligible for issuance pursuant to the non-employee director deferred compensation plan: Mr. Kearney – 6,724; Mr. O’Leary – 4,556; Mr. Renwick – 6,356; Ms. Robak – 1,877; Mr. Simons – 5,741; and all directors as a group – 25,254.

Mr. Dillon is a trustee of the Dillon Foundation which holds 133,750 shares of our common stock. Mr. Yabuki is a trustee of the Yabuki Family Foundation which holds 3,500 shares of our common stock. As a trustee, Mr. Dillon or Mr. Yabuki, as applicable, has voting and investment power over the shares held by the foundation. These shares are, accordingly, included in their respective reported beneficial ownership.

| (3) |

3

| On |

| Based on a Schedule 13G filed by BlackRock, Inc. (“BlackRock”) on February 9, 2012 with the Securities and Exchange Commission, which indicates that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, these securities. According to the Schedule 13G, BlackRock exercises sole voting and dispositive power over all of these securities. |

| (5) | Based on a Schedule 13G filed jointly by FMR LLC (“FMR”) and Edward C. Johnson 3d (“Johnson”) on February 14, 2012 with the Securities and Exchange Commission, which indicates that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, these securities. According to the Schedule 13G, FMR exercises sole voting power over 1,637,856 of the securities and FMR and Johnson exercise sole dispositive power over 8,048,612 of the securities. |

| (6) | Based on a Schedule 13G filed by T. Rowe Price Associates, Inc. (“Price Associates”) on February |

4

| (7) | Based on a Schedule 13G filed by The Vanguard Group, Inc. (“Vanguard Group”) on February 10, 2012 with the Securities and Exchange Commission, which indicates that the Vanguard Group exercises sole voting power and shared dispositive power over 198,056 of the securities and sole dispositive power over 7,682,432 of the securities. According to the Schedule 13G, Vanguard Fiduciary Trust Company (“VFTC”), a wholly-owned subsidiary of Vanguard Group, is the beneficial owner of 198,056 of the securities as a result of VFTC serving as investment manager of collective trust accounts and directing the voting of these securities. |

| (8) | Mr. Kight is retiring from our board when his term expires at the 2012 annual meeting. |

5

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors

Our articles of incorporation currently provide for a board of directors that is divided into three classes. The terms for each class are three years, staggered over time. There are no family relationships among any of our directors or executive officers, and no nominee for director has been nominated pursuant to any agreement or understanding between us and any person.

All of the nominees for election as director at the annual meeting are incumbent directors. These nominees have consented to serve as a director if elected, and management has no reason to believe that any nominee will be unable to serve. Unless otherwise specified, the shares of common stock represented by the proxies solicited hereby will be voted in favor of the nominees proposed by the board of directors. In the event that any director nominee becomes unavailable for re-election as a result of an unexpected occurrence, shares will be voted for the election of such substitute nominee, if any, as the board of directors may propose.

4

The affirmative vote of a majority of votes cast is required for the election of directors. A description of the majority voting provisions in our by-laws appears below under the heading “– Majority Voting.”

Nominees for Election

Each person listed below is nominated for election to serve as a director until the annual meeting of shareholders in the year in which his or her term expires and until his or her successor is elected and qualified.The board of directors recommends that you voteFOR in favor of its nominees for director.

Three-year terms expiring in 20122015

Daniel P. Kearney (age 69)72) has been a director since 1999. Mr. Kearney is a financial consultant and served as Chief Investment Officer of Aetna, Inc. from 1991 to 1998. In 1995, he assumed the additional responsibility of President of Aetna’s annuity, pension and life insurance division, and retiredretiring in 1998. Prior to joining Aetna, Mr. Kearney was President and Chief Executive Officer of the Resolution Trust Corporation Oversight Board. Before that, he was a principal at Aldrich, Eastman and Waltch, Inc., a Boston-based pension fund advisor. From 1977 to 1988, Mr. Kearney was with Salomon Brothers, Inc. as Managing Director of its Real Estate Financing Department and a founder of its Mortgage Securities Department, and from 1976 to 1977 he was Associate Director of the United States Office of Management and Budget. He served as President of the Government National Mortgage Association (Ginnie Mae) from 1974 to 1976, Deputy Assistant Secretary of the Department of Housing and Urban Development from 1973 to 1974, and as Executive Director of the Illinois Housing Development Authority from 1969 to 1973. Previously, he was in private law practice in Chicago, Illinois. In the past five years, in addition to Fiserv, Mr. Kearney hasserved as a director of MGIC Investment Corporation (current), a publicly traded mortgage insurance company, and non-executive Chairman of MBIA, Inc. (current), a publicly traded financial guarantor. The board concluded that Mr. Kearney should be a director of the company because of his over 3040 years of experience in the banking, insurance and legal industries. Mr. Kearney also serves as a director of MGIC Investment Corporation, a publicly traded mortgage insurance company, and MBIA, Inc., a publicly traded financial guarantor.Principal Occupation: Financial ConsultantConsultant..

Peter J. Kight (age 52) has been a director and Vice Chairman since 2007. Mr. Kight is the founder of CheckFree Corporation, which was acquired by Fiserv in 2007, and served as its Chairman and Chief Executive Officer from 1981 to 2007. Mr. Kight joined Fiserv’s board of directors in connection with the acquisition of CheckFree. Mr. Kight also serves as a director of Akamai Technologies, Inc., a publicly traded company that distributes computing solutions and services, and Manhattan Associates, Inc., a publicly traded company that provides supply chain planning and execution solutions.Principal Occupation: Vice Chairman of Fiserv, Inc.

Jeffery W. Yabuki (age 49)52) has been a director and our President and Chief Executive Officer since 2005. Before joining Fiserv, Mr. Yabuki served as Executive Vice President and Chief Operating Officer for H&R Block, Inc., a financial services firm, from 2002 to 2005. From 2001 to 2002, he served as Executive Vice President of H&R Block and from 1999 to 2001, he served as the President of H&R Block International. From 1987 to 1999, Mr. Yabuki held various executive positions with American Express Company, a financial services firm, including President and Chief Executive Officer of American Express Tax and Business Services, Inc. In

6

the past five years, in addition to Fiserv, Mr. Yabuki served on the board of directors of PetSmart, Inc. (former), a publicly traded specialty retailer of pet products and services, and MBIA, Inc. (former), a publicly traded financial guarantor. The board concluded that Mr. Yabuki should be a director of the company because he has extensive senior management experience at a number of large corporations and serves as the chief executive officer of the company.Principal Occupation: President and Chief Executive Officer of Fiserv, Inc.

Continuing Directors

Continuing terms expiring in 20102013

Kim M. Robak (age 53)56) has been a director since 2003. Ms. Robak is a partner at Ruth, Mueller & Robak, LLC.LLC, a government relations firm. Previously, Ms. Robak was Vice President for External Affairs and Corporation Secretary at the University of Nebraska from 1999 to 2004. Ms. Robak served as the Lieutenant Governor of the State of Nebraska as Lieutenant Governor from 1993 to 1999, as Chief of Staff from 1992 to 1993, and as Legal Counsel from 1991 to 1992. Prior to 1991, Ms. Robak was a partner of the law firm Rembolt Ludtke Milligan and Berger. During her tenure in state government, she chaired the Governor’s Information Resources Cabinet and led the Information Technology Commission of Nebraska. She also serves as a director of: FBL Financial Group, Inc.In the past five years, in addition to Fiserv, Ms. Robak served on the board of directors of UNIFI Mutual Holding Company (current), a provider of life insurance, annuities, and mutual funds to individualsfunds; Union Bank & Trust Company (current), a financial institution; FBL Financial Group, Inc. (former), a publicly traded life insurance holding company; and small businesses; First Ameritas Life Insurance Corporation of New York (former), a life insurance company;company. The board concluded that Ms. Robak should be a director of the company because she is an accomplished business person and Union Bank & Trust Company,community leader who brings a financial institution.variety of experiences to the board through her work in the fields of law, government and technology.Principal Occupation: Partner at Ruth, Mueller & Robak, LLC.

Doyle R. Simons (age 48) has been a director since 2007. Mr. Simons served as the Chairman and Chief Executive Officer of Temple-Inland, Inc. from 2007 to early 2012. Prior to that, he served in a variety of other roles for Temple-Inland: from 2005 to 2007, he was Executive Vice President of Temple-Inland, Inc.; from 2003 to 2005, he served as its Chief Administrative Officer; from 2000 to 2003, he was Vice President – Administration; and from 1994 to 2000, he served as Director of Investor Relations. In the past five years, in addition to Fiserv, Mr. Simons served on the board of directors of Temple-Inland, Inc., a formerly publicly traded manufacturing company focused on corrugated packaging and building products which was acquired in 2012. The board concluded that Mr. Simons should be a director of the company because he is an accomplished business person with diverse experiences in senior management and financial and legal matters.Principal Occupation: Private Investor.

5

Thomas C. Wertheimer (age 68)71) has been a director since 2003. Mr. Wertheimer is a Certified Public Accountant and a retired Senior Audit Partner of PricewaterhouseCoopers (“PwC”). He served as lead audit partner for a number of key multinational and national clients of PwC, including publicly held automotive manufacturing, financial services and retail companies. He also held technical accounting and audit quality positions including Director of Accounting, Auditing and SEC for the Midwest Region of Coopers & Lybrand. Mr. Wertheimer served on the Board of Partners at Coopers & Lybrand from 1995 until its merger with Price Waterhouse in 1998. From 2003 to 2007, he was a consultant to the Public Company Accounting Oversight Board, assisting in designing and executing its program of inspection of registered accounting firms. In the past five years, in addition to Fiserv, Mr. Wertheimer currently serves as a directorserved on the board of directors of Vishay Intertechnology, Inc. (current), a publicly traded electronic component manufacturer, and Xinyuan Real Estate Co., Ltd. (current), a publicly traded residential real estate developer in China. The board concluded that Mr. Wertheimer should be a director of the company because of his extensive knowledge of and experience in accounting, auditing and financial reporting matters.Principal Occupation: Financial Consultant.

Doyle R. Simons (age 45) has been a director since 2007. Mr. Simons is the Chairman and Chief Executive Officer of Temple-Inland, Inc. From 2005 to 2007, he was Executive Vice President of Temple-Inland, Inc.; from 2003 to 2005, he served as its Chief Administrative Officer; from 2000 to 2003, he was Vice President – Administration.Principal Occupation: Chairman and Chief Executive Officer of Temple-Inland, Inc.

7

Continuing terms expiring in 20112014

Donald F. Dillon (age 69)72) has been Chairman of the board of directors since 2000. Mr. Dillon served as Vice Chairman of the board of directors from 1995 to 2000. In 1976, Mr. Dillon and an associate founded Information Technology, Inc. (“ITI”), a provider of banking software and services. ITI was acquired by Fiserv in 1995, and, since then, Mr. Dillon has continued in his post as Chairman of ITI.1995. From 1966 to 1976, Mr. Dillon was with the National Bank of Commerce, Lincoln, Nebraska and served as Senior Vice President – Information Management Division. In the past five years, in addition to Fiserv, Mr. Dillon has over 40 years of experience in the financial and data processing industries. He also serves asserved as: a member of the Board of Trustees for the University of Nebraska and(current); a member of the University of Nebraska’s Directors Club.Club (current); and the Chairman of the Board of Trustees of Doane College (former). The board concluded that Mr. Dillon should serve as the company’s Chairman of the Board of Directors because, as the founder of ITI, he brings more than 40 years of experience in the financial and data processing industries.Principal Occupation: Chairman of the Board of Directors of Fiserv, Inc.

Gerald J. Levy (age 77) has been a director since 1986 and is known nationally for his involvement in various financial industry organizations. Mr. Levy is a past Director and Chairman of the United States League of Savings Institutions, and served as Chairman of its Government Affairs Policy Committee. Since 1959, Mr. Levy has served Guaranty Bank, Milwaukee, Wisconsin, in various capacities, including as Chairman since 2002 and Chief Executive Officer from 1973 to 2002. He also serves as a director of Guaranty Bank and Guaranty Financial M.H.C., the holding company of Guaranty Bank.Principal Occupation: Chairman of Guaranty Bank.

Denis J. O’Leary(age 52) (age 55) has been a director since 2008. In 2009, Mr. O’Leary isbecame managing partner of Encore Financial Partners, Inc., a consultantcompany focused on the acquisition and management of banking organizations in the United States. From 2006 to 2009, he was a senior advisor to The Boston Consulting Group with respect to the enterprise technology, financial services, and consumer payments industries both directly, and, since 2006, as a senior advisor to The Boston Consulting Group. He is also a private investor primarily focusing on private, early stage companies.industries. Through early 2003, he spent 25 years at J.P. Morgan Chase & Company and its predecessors in various capacities, including Director of Finance, Chief Information Officer, Head of Retail Branch Banking, Managing Executive of Chase.com/Lab Morgan, and, from 1994 to 2003, Executive Vice President. Since 2003,In the past five years, in addition to Fiserv, Mr. O’Leary has served on the board of directors of McAfee, Inc. (former), a formerly publicly traded supplier of computer security solutions.solutions, and Hamilton State Bancshares, Inc. (current), a privately held bank holding company. The board concluded that Mr. O’Leary should be a director of the company because of his extensive knowledge of and experience in both the banking and information technology industries.Principal Occupation: Consultant.Managing Partner, Encore Financial Partners, Inc.

Glenn M. Renwick (age 53)56) has been a director since 2001. Mr. Renwick is President and Chief Executive Officer of The Progressive Corporation. Before being named Chief Executive Officer in 2001, Mr. Renwick served as Chief Executive Officer – Insurance Operations and Business Technology Process Leader from 1998 through 2000. Prior to that, he led Progressive’s consumer marketing group and served as president of various divisions within Progressive. Mr. Renwick joined Progressive in 1986 as Auto Product Manager for Florida. He is also a directorIn the past five years, in addition to Fiserv, Mr. Renwick served on the board of directors of The Progressive Corporation (current), a publicly traded property and casualty insurance company, and UnitedHealth Group Incorporated (current), a publicly traded provider of health care insurance company.insurance. The board concluded that Mr. Renwick should be a director of the company because he is an accomplished business leader with significant information technology experience.Principal Occupation: President and Chief Executive Officer of The Progressive Corporation.

6

Majority Voting

Our by-laws provide that each director will be elected by the majority of the votes cast with respect to that director’s election at any meeting of shareholders for the election of directors, other than a contested election. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “withheld” with respect to that director’s election. In a contested election, each director will be elected by a plurality of the votes cast with respect to that director’s election. Once our chairman of the board determines that a contested election exists in accordance with our by- laws,by-laws, the plurality vote standard will apply at a meeting at which a quorum is present regardless of whether a contested election continues to exist as of the date of such meeting.

Our by-laws further provide that, in an uncontested election of directors, any nominee for director who is already serving as a director and receives a greater number of votes “withheld” from his or her election than votes “for” his or her election (a “Majority Against Vote”) will promptly tender his or her resignation. The nominating and

8

corporate governance committee of the board of directors will then promptly consider the resignation submitted by a director receiving a Majority Against Vote, and the committee will recommend to the board whether to accept the tendered resignation or reject it.

The board of directors will act on the committee’s recommendation no later than 90 days following the date of the meeting during which the Majority Against Vote occurred. In considering the committee’s recommendation, the board will consider the factors considered by the committee and such additional information and factors the board believes are relevant. Following the board’s decision, we will promptly file a Current Report on Form 8-K with the Securities and Exchange Commission that sets forth the board’s decision whether to accept the resignation as tendered, including a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the tendered resignation. Any director who tenders a resignation pursuant to this provision will not participate in the committee recommendation or the board consideration regarding whether to accept the tendered resignation. Our by-laws set forth the procedure for acting if a majority of the members of the committee receive Majority Against Votes at the same election.

9

PROPOSAL 2

APPROVAL OF THEAMENDMENT TO ARTICLES OF INCORPORATION

AMENDED AND RESTATED FISERV, INC. EMPLOYEE STOCK PURCHASE PLANCurrent Classified Board Structure

Background

We adopted the Fiserv, Inc. Employee Stock Purchase Plan (the “ESPP”) effective January 1, 2000 to allow eligible employees and thoseArticle VII of our designated participating subsidiaries to purchase sharesarticles of incorporation and Section 2 of Article III of our common stockby-laws divides our directors into three classes, with members of each class serving three-year terms of office. Consequently, at a discount. The ESPP is subjectany annual meeting of shareholders, the shareholders have the ability to the requirementselect one class of Section 423directors, constituting approximately one-third of the Internal Revenue Codeentire board of 1986, as amended (the “Code”). As required bydirectors.

Amendment to Articles of Incorporation to Declassify our Board of Directors

Our board of directors has approved, and recommends that our shareholders approve at the Codeannual meeting, an amendment to our articles of incorporation that would eliminate the classified structure and the terms of the ESPP, the ESPP will expire on January 1, 2010. We propose that you approve the ESPP, as amended and restated effective January 1, 2010 (the “Amended ESPP”). The following is a summary of the principal features of the Amended ESPP. The summary is qualified in its entirety by the terms of the Amended ESPP, a copy of which is attached hereto as Appendix A and incorporated by reference herein.

Purpose of the Amended ESPP

The purpose of the Amended ESPP is to allow employees to continue to have the opportunity to purchase shares of our common stock on favorable terms and thereby acquire and enlarge their stake in our growth and earnings.

Shares Subject to the ESPP and Eligibility

Under the Amended ESPP, a total of 1,200,000 shares of our common stock are initially available for purchase by participants effective January 1, 2010. The Amended ESPP also providesprovide for an annual increase in shares available for purchase by participants on the first day of each of our fiscal years, beginning in 2011, equal to the least of: (i) 1,000,000 shares; (ii) 1% of the shares of our common stock outstanding on such date; or (iii) a lesser

7

amount determined by our boardelection of directors. The share limitsamendment provides that directors who have been or will be elected to three-year terms prior to the annual meeting of shareholders held in 2013 will complete those terms. Beginning with the annual meeting of shareholders held in 2013, and at all annual meetings thereafter, directors whose terms are expiring will be subject to appropriate adjustmentselection for a one-year term expiring at the next annual meeting. As a result, directors whose terms expire in 2013, 2014 and 2015 will first be elected for one-year terms beginning in those respective years. Beginning with the 2015 annual meeting of shareholders, the entire board of directors will be elected annually.

Rationale for Declassification

In determining whether to reflect stock splits and other changes in our capitalization.

Our employees and the employees of our designated subsidiaries who normally work at least five months per year are eligible to participate in the Amended ESPP.

Participants may elect to have up to 10% of their gross compensation deducted from their pay. The amounts withheld from payroll may be used by us for any corporate purpose, are not segregated and do not earn interest. On the last business day of each calendar quarter, or such other datepropose declassification as may be specified by our compensation committee, the amounts withheld from an employee’s compensation are used to purchase shares of our common stock at a price equal to 85% of its then current fair market value. No employee may purchase more than $25,000 in market value of our common stock (determined on the respective purchase dates) during any calendar year. Furthermore, no employee may purchase common stock under the Amended ESPP if, after the purchase, he or she would own, or would hold options to purchase, 5% or more of the total outstanding shares of our common stock.

Administration, Duration and Amendment of the ESPP

The Amended ESPP is administered bydescribed above, our board of directors which hascarefully reviewed the exclusive right to construe the Amended ESPPvarious arguments for and to correct errors, rectify omissions and reconcile inconsistencies to the extent necessary to effectuate the Amended ESPP.against a classified board structure. Our board of directors recognizes that a classified structure may amendoffer several advantages, such as promoting continuity and stability, encouraging directors to take a long-term perspective and reducing our vulnerability to coercive takeover tactics. The board of directors also recognizes, however, that a classified structure may appear to reduce directors’ accountability to shareholders because such a structure does not enable shareholders to express a view on each director’s performance by means of an annual vote. Our board of directors believes that implementing annual elections for all directors is consistent with our shareholder’s expectations and our ongoing commitment to corporate governance “best practices” where the Amended ESPP, providedboard of directors believes that any amendment which increases the numbersame are in the best interests of shares issuable underour shareholders. In view of the Amended ESPP or changes the eligibility requirements for the Amended ESPP requires shareholder approval. The Amended ESPP will remain in effect until January 1, 2020, unless terminated earlier byconsiderations described above, our board of directors.directors has unanimously determined that it is in our and the shareholders’ best interests to eliminate the classified structure as proposed.

Federal Income Tax TreatmentText and Effectiveness of Amendment to Articles of Incorporation

The Amended ESPP is intendedIf shareholders approve the amendment to qualifyour articles of incorporation, Article VII of our articles of incorporation will be amended and restated in its entirety as an “employee stock purchase plan” withinset forth in Appendix A attached to this proxy statement. Under Wisconsin law, if shareholders approve the meaningamendment, the amendment will become legally effective when we file articles of Section 423amendment with the Wisconsin Department of Financial Institutions, which we intend to do promptly following the annual meeting.

Amendment to By-Laws

Our board of directors has approved, subject to shareholder approval of the Code. Participant contributionsamendments to Article VII of our articles of incorporation, amendments to our by-laws that will conform provisions relating to the Amended ESPPelection of directors to those set forth in the form of payroll deductions are after-tax contributions and are subjectproposed amended Article VII. The amendments to normal income and payroll tax withholding requirements. However, there are no tax consequences associated with the acquisition and ownership of shares of common stock under the Amended ESPP until the participant sells the shares, disposes of them by gift, or dies. The tax treatment upon disposition of the shares depends on whether the shares are disposed of within the two year required holding period, which is measured from the date the option to purchase such shares was granted to the participant. The required holding period is also satisfied if the participant dies while holding shares acquired under the Amended ESPP.

A participant who doesour by-laws do not satisfy the two-year holding period must pay ordinary income tax, at the time of the disposition of the shares, on the 15% discount on the purchase price, even if the market price of the stock at the time the stock is disposed of is lower than the purchase price. The difference between the amount received at disposition and the fair market value of the shares on the date of purchase will be a capital gain or loss.

require any shareholder action. If the participant holds the shares of common stock for at least two years, or dies while owning the shares, at the time of disposition of the shares, ordinary income tax must be paid on an amount equal to the lesser of: (i) 15% of the fair market value of a share on the date the option to purchase such stock was granted to the participant; or (ii) the amount, if any, by which the market price at the time of disposition exceeds the purchase price. The basis of the shares of common stock purchased will be the purchase price plus any ordinary income recognized. Any amount received at disposition in excess of the adjusted basis of the stock will be capital gain. If the shares are sold for less than the purchase price, the difference between the sale price and the purchase price will be a capital loss.

If the disposition does not satisfy the required two-year holding period, the disposition is called a “disqualifying disposition.” If a disqualifying disposition occurs, we will be entitled to a tax deduction equal to the amount that the participant includes as ordinary income in the year in which the disqualifying disposition occurs. Weshareholders do not receive a deduction atapprove the timeamendment to our articles of disposition ifincorporation, then the participant meets the holding period requirements.conforming amendments to our by-laws will not take effect.

8

Plan Benefits; Interest of Certain Persons in Matters to be Acted Upon

Each of our executive officers is eligible to purchase up to $25,000 worth of our common stock each calendar year under the Amended ESPP at a discount to the applicable market price. Non-employee directors are not eligible to purchase shares under the Amended ESPP. Participation in the Amended ESPP is voluntary and depends on each eligible employee’s election to participate and on his or her election regarding payroll deductions. Accordingly, future purchases by executive officers and other eligible employees under the Amended ESPP are not determinable.

On March 27, 2009, the closing price per share of our common stock on the Nasdaq Global Select Market was $35.77.

Vote Required and Recommendation of the Board of Directors

To approve the Amended ESPP, the affirmative voteamendment to our articles of a majority ofincorporation, the votes cast in person or by proxy at“for” the annual meeting is required.approval of the amendment to the articles of incorporation must exceed the votes cast “against” the amendment. Unless otherwise specified, the proxies solicited hereby will be voted to approvein favor of the Amended ESPP.amendment.

The board of directors recommends that you vote in favor of Proposal 2.

11

PROPOSAL 3

APPROVAL OF PERFORMANCE GOALS AND RELATED MATTERS UNDER THE INCENTIVE PLAN

Background

In 2007, our shareholders adopted the Fiserv, Inc. 2007 Omnibus Incentive Plan, a copy of which is attached hereto as Appendix B. We are asking our shareholders to approve the following three items under the Incentive Plan:

The performance goals under the Incentive Plan described below under the heading “Performance Goals.” Achievement of specified performance levels under some or all of these performance goals will be a condition to the vesting of awards under the Incentive Plan in the future if such awards have performance conditions to vesting or payment.

The employees eligible to receive awards under the Incentive Plan as described below under “Administration and Eligibility.”

The maximum amount of awards that may be granted to key employees during any calendar year under the Incentive Plan as described below under “Award Limits.”

We arenot asking our shareholders to approve an increase in the number of shares authorized under the Incentive Plan or any amendment to the Incentive Plan.

Shareholder approval of these items is required so that the compensation expense resulting from future awards, the vesting or payment of which is conditioned on achievement of performance goals, is not subject to the limitation on income tax deductibility under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Under Section 162(m), we may not deduct compensation in excess of $1 million paid in a year to our Chief Executive Officer and our next three highest paid executive officers (other than our Chief Financial Officer) for that year unless the compensation is payable solely on account of the achievement of pre-established, objective performance goals. If our shareholders do not approve the three items described above, we will not be able to deduct compensation expense in excess of this limit resulting from the vesting of future grants of awards with such performance conditions to vesting or payment. In such event, we will still be able to make awards under the Incentive Plan that do not comply with Section 162(m) of the Code.

Summary of the Terms of the Incentive Plan

The following is a summary of the material provisions of the Incentive Plan. This summary is qualified in its entirety by reference to the full and complete text of the Incentive Plan. Any inconsistencies between this summary and the text of the Incentive Plan will be governed by the text of the Incentive Plan.

Administration and Eligibility

The Incentive Plan is administered by the compensation committee or the board of directors with respect to employee participants and the board of directors with respect to director participants (we refer to such committee or board, as the case may be, as the “administrator”), which have the authority to interpret the provisions of the Incentive Plan; make, change and rescind rules and regulations relating to the Incentive Plan; and change or reconcile any inconsistency in any award or agreement covering an award. The administrator may designate any of the following as a participant under the Incentive Plan to the extent consistent with its authority: any of our or our affiliates’ officers or other employees or individuals engaged to become such an officer or employee, consultants who provide services to us or our affiliates and our non-employee directors. The selection of participants will be based upon the administrator’s opinion that the participant is in a position to contribute materially to our continued growth and development and to our long-term financial success. We currently have eight non-employee directors and approximately 1,200 employees who are eligible to participate in the Incentive Plan.

12

The board may delegate some or all of its authority under the Incentive Plan to a committee of the board, and the compensation committee may delegate some or all of its authority under the Incentive Plan to a sub-committee or one or more of our officers. Delegation is not permitted, however, with respect to stock-based awards made to individuals subject to Section 16b-3 of the Exchange Act unless the delegation is to a committee of the board that consists only of outside directors.

Shares Reserved under the Incentive Plan

The Incentive Plan provides that 10,000,000 shares of common stock are reserved for issuance under the plan. As of March 15, 2012, 8,623,446 shares have been granted and 2,639,319 shares remain to be granted. The Incentive Plan also provides that we may only issue an aggregate of 2,500,000 shares of common stock upon the exercise of incentive stock options and 4,000,000 shares of common stock pursuant to awards of restricted stock, restricted stock units, performance shares, performance units valued in a relation to a share of common stock and any other similar award under which the value of the award is measured as the full value of a share of common stock, rather than the increase in the value of a share. In general, if an award granted under the Incentive Plan expires, is canceled or terminates without the issuance of shares, if shares are forfeited under an award, or if shares are issued under any award and we reacquire them pursuant to rights we reserved upon the issuance of the shares, then such shares will again be available for issuance under the Incentive Plan.

Types of Awards

Awards under the Incentive Plan may consist of stock options, stock appreciation rights, performance shares, performance units, restricted stock, restricted stock units, dividend equivalent units, incentive cash awards or other equity-based awards. The administrator may grant any type of award to any participant it selects, but only our and our subsidiaries’ employees may receive grants of incentive stock options. Awards may be granted alone or in addition to, in tandem with, or in substitution for any other award (or any other award granted under another plan of ours or of any of our affiliates).

Options

The administrator has the authority to grant stock options and to determine all terms and conditions of each stock option. Stock options will be granted to participants at such time as the administrator may determine. The administrator will also determine the number of options granted and whether an option is to be an incentive stock option or non-qualified stock option. The administrator will fix the option price per share of common stock, which may not be less than the fair market value of the common stock on the date of grant. Fair market value is defined as the last sales price of a share of our common stock for the date in question, or if no sales of our common stock occur on such date, on the last preceding date on which there was such a sale. The administrator will determine the expiration date of each option, but the expiration date will not be later than 10 years after the grant date. Options will be exercisable at such times and be subject to such restrictions and conditions as the administrator deems necessary or advisable. The stock option exercise price will be payable in full upon exercise in cash or its equivalent, by tendering shares of previously acquired common stock having a fair market value at the time of exercise equal to the exercise price, or by a combination of the two.

Stock Appreciation Rights

The administrator has the authority to grant stock appreciation rights. A stock appreciation right is the right of a participant to receive cash, common stock, or both cash and stock, with a fair market value equal to the appreciation of the fair market value of a share of common stock during a specified period of time. The Incentive Plan provides that the administrator will determine all terms and conditions of each stock appreciation right, including: whether the stock appreciation right is granted independently of a stock option or relates to a stock option; the number of shares of common stock to which the stock appreciation right relates; a grant price that is not less than the fair market value of the common stock subject to the stock appreciation right on the date of grant; the terms and conditions of exercise or maturity; a term that must be no later than 10 years after the date of grant; and whether the stock appreciation right will settle in cash, common stock or a combination of the two.

13

Performance and Stock Awards

The administrator has the authority to grant awards of restricted stock units, restricted stock, performance shares or performance units. Restricted stock unit means the right to receive a payment equal to the fair market value of one share of common stock. Restricted stock means shares of common stock that are subject to a risk of forfeiture, restrictions on transfer or both a risk of forfeiture and restrictions on transfer. Performance shares means the right to receive shares of common stock to the extent performance goals are achieved. Performance unit means the right to receive a payment valued in relation to a unit that has a designated dollar value or the value of which is equal to the fair market value of one or more shares of common stock, to the extent performance goals are achieved.

The administrator will determine all terms and conditions of the awards, including: the number of shares of common stock and/or units to which such award relates; whether performance goals need to be achieved for the participant to realize any portion of the benefit provided under the award; whether the restrictions imposed on restricted stock or restricted stock units will lapse, and any portion of the performance goals subject to an award will be deemed achieved, upon a participant’s death, disability or retirement; with respect to performance units, whether to measure the value of each unit in relation to a designated dollar value or the fair market value of one or more shares of common stock; and, with respect to performance units, whether the awards will settle in cash, in shares of common stock, or in a combination of the two.

Incentive Awards

The administrator has the authority to grant annual and long-term incentive awards. An incentive award is the right to receive a cash payment to the extent that one or more performance goals are achieved. The administrator will determine all terms and conditions of an annual or long-term incentive award, including the performance goals, performance period, the potential amount payable and the timing of payment. The administrator must require that payment of all or any portion of the amount subject to the incentive award is contingent on the achievement of one or more performance goals during the period the administrator specifies. The administrator may deem that performance goals subject to an award are achieved upon a participant’s death, disability or retirement, or such other circumstances as the administrator may specify. The performance period for an annual incentive award must relate to a period of one fiscal year, and the performance period for a long-term incentive award must relate to a period of more than one fiscal year, except that, in each case, if the award is made in the year the Incentive Plan becomes effective, at the time of commencement of employment with us or on the occasion of a promotion, then the award may relate to a shorter period.

Dividend Equivalent Units

The administrator has the authority to grant dividend equivalent units. A dividend equivalent unit is the right to receive a payment, in cash or shares of common stock, equal to the cash dividends or other distributions that we pay with respect to a share of common stock. The administrator will determine all terms and conditions of a dividend equivalent unit award, including whether: the award will be granted in tandem with another award; payment of the award be made currently or credited to an account for the participant which provides for the deferral of such amounts until a stated time; and the award will be settled in cash or shares of common stock.

Other Awards

The administrator has the authority to grant other types of awards, which may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, shares of common stock, either alone or in addition to or in conjunction with other awards, and payable in shares of common stock or cash. Such awards may include shares of unrestricted common stock, which may be awarded, without limitation, as a bonus, in payment of director fees, in lieu of cash compensation, in exchange for cancellation of a compensation right, or upon the attainment of performance goals or otherwise, or rights to acquire shares of our common stock from us. The administrator will determine all terms and conditions of the award, including the time or times at which such award will be made and

14

the number of shares of common stock to be granted pursuant to such award or to which such award will relate. Any award that provides for purchase rights must be priced at 100% of the fair market value of our common stock on the date of the award.

Performance Goals

For purposes of the Incentive Plan, performance goals mean any goals the administrator establishes that relate to one or more of the following with respect to us or any one or more of our subsidiaries, affiliates or other business units: net sales; cost of sales; revenues; gross income; net income; operating income; income from continuing operations; earnings (including before interest and/or taxes and/or depreciation and amortization); earnings per share (including diluted earnings per share); cash flow; net cash provided by operating activities; net cash provided by operating activities less net cash used in investing activities; net operating profit; ratio of debt to debt plus equity; return on shareholder equity; return on capital; return on assets; operating working capital; average accounts receivable; economic value added; customer satisfaction; operating margin; profit margin; sales performance; sales quota attainment; new sales; cross/integrated sales; client engagement; client acquisition; net promoter score; internal revenue growth; and client retention. In the case of awards that the administrator determines will not be considered “performance-based compensation” under Section 162(m) of the Internal Revenue Code, the administrator may establish other performance goals not listed in the Incentive Plan.

Award Limits

In order to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code, we are required to establish limits on the number of awards that we may grant to a particular participant. The award limits in the Incentive Plan were established in order to provide us with maximum flexibility and are not necessarily indicative of the size of award that we expect to make to any particular participant. Under the Incentive Plan, no participant may be granted awards that could result in such participant: receiving options for, or stock appreciation rights with respect to, more than 500,000 shares of common stock during any fiscal year; receiving awards of restricted stock or restricted stock units relating to more than 120,000 shares of common stock during any fiscal year; receiving awards of performance shares or awards of performance units, the value of which is based on the fair market value of common stock, for more than 120,000 shares of common stock during any fiscal year; receiving awards of performance units, the value of which is not based on the fair market value of shares of common stock, of more than $3,000,000 in any fiscal year; receiving other stock-based awards not described above and that are intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code with respect to more than 120,000 shares of common stock during any fiscal year; receiving an annual cash incentive award of more than $3,000,000 in any single fiscal year; or receiving a long-term cash incentive award of more than $6,000,000 in any fiscal year. Each of these limitations is subject to adjustment as described above.

Transferability

Awards are not transferable other than by will or the laws of descent and distribution, unless the administrator allows a participant to designate in writing a beneficiary to exercise the award or receive payment under an award after the participant’s death or to transfer an award for no consideration.

Adjustments

If: (A) we are involved in a merger or other transaction in which our common stock is changed or exchanged; we subdivide or combine our common stock or we declare a dividend payable in our common stock, other securities (other than stock purchase rights issued pursuant to a shareholder rights agreement) or other property; we effect a cash dividend, the amount of which, on a per share basis, exceeds 10% of the fair market value of a share of common stock at the time the dividend is declared, or we effect any other dividend or other distribution on our common stock in the form of cash, or a repurchase of shares of common stock, that the board of directors determines is special or extraordinary in nature or that is in connection with a transaction that we characterize

15

publicly as a recapitalization or reorganization involving our common stock; or any other event occurs, which, in the judgment of the board of directors or compensation committee necessitates an adjustment to prevent an increase or decrease in the benefits or potential benefits intended to be made available under the Incentive Plan; then (B) the administrator will, in a manner it deems equitable to prevent an increase or decrease in the benefits or potential benefits intended to be made available under the Incentive Plan and subject to certain provisions of the Internal Revenue Code, adjust the number and type of shares of common stock subject to the Incentive Plan and which may, after the event, be made the subject of awards; the number and type of shares of common stock subject to outstanding awards; the grant, purchase or exercise price with respect to any award; and performance goals of an award.

In any such case, the administrator may also provide for a cash payment to the holder of an outstanding award in exchange for the cancellation of all or a portion of the award. However, if the transaction or event constitutes a change of control, as defined in the Incentive Plan, then the payment must be at least as favorable to the holder as the greatest amount the holder could have received for such award under the change of control provisions of the Incentive Plan. The administrator may, in connection with any merger, consolidation, acquisition of property or stock, or reorganization, and without affecting the number of shares of common stock otherwise reserved or available under the Incentive Plan, authorize the issuance or assumption of awards upon terms it deems appropriate.

Change of Control

Unless otherwise provided in an applicable employment, retention, change of control, severance, award or similar agreement, in the event of a change of control, the successor or purchaser in the change of control transaction may assume an award or provide a substitute award with similar terms and conditions and preserving the same benefits as the award it is replacing. If the awards are not so assumed or replaced, then unless otherwise determined by the board of directors prior to the date of the change of control, immediately prior to the date of the change of control:

each stock option or stock appreciation right that is then held by a participant who is employed by or in the service of us or one of our affiliates will become fully vested, and all stock options and stock appreciation rights will be cancelled in exchange for a cash payment equal to the excess of the change of control price (as determined by the administrator) of the shares of common stock covered by the stock option or stock appreciation right over the purchase or grant price of such shares of common stock under the award;

restricted stock and restricted stock units that are not vested will vest;

each holder of a performance share and/or performance unit that has been earned but not yet paid will receive cash equal to the value of the performance share and/or performance unit, and each performance share and/or performance unit for which the performance period has not expired will be cancelled in exchange for a cash payment equal to the value of the performance share and/or performance unit multiplied by a percentage based on the portion of the performance period that has elapsed as of the date of the change of control;

all incentive awards that are earned but not yet paid will be paid, and all incentive awards that are not yet earned will be cancelled in exchange for a cash payment equal to the amount that would have been due if the performance goals (measured at the time of the change of control) continued to be achieved through the end of the performance period multiplied by a percentage based on the portion of the performance period that has elapsed as of the date of the change of control;

all dividend equivalent units that are not vested will vest and be paid in cash; and

all other awards that are not vested will vest, and if an amount is payable under such vested award, then such amount will be paid in cash based on the value of the award.

16

Term of Incentive Plan

Unless earlier terminated by our board of directors, the Incentive Plan will remain in effect until all common stock reserved for issuance under the Incentive Plan has been issued. If the term of the Incentive Plan extends beyond 10 years, no incentive stock options may be granted after such time unless our shareholders approve an extension of the Incentive Plan.

Termination and Amendment

The board of directors or the compensation committee may amend, alter, suspend, discontinue or terminate the Incentive Plan at any time, except:

the board of directors must approve any amendment to the Incentive Plan if we determine such approval is required by action of the board, applicable corporate law or any other applicable law;

shareholders must approve any amendment to the Incentive Plan if we determine that such approval is required by Section 16 of the Exchange Act, the listing requirements of any principal securities exchange or market on which our common stock is then traded, or any other applicable law; and

shareholders must approve any amendment to the Incentive Plan that materially increases the number of shares of common stock reserved under the Incentive Plan or the per participant award limitations set forth in the Incentive Plan or that diminishes the provisions on repricing or backdating stock options and stock appreciation rights.

The administrator may modify, amend or cancel any award or waive any restrictions or conditions applicable to any award or the exercise of the award. Any modification or amendment that materially diminishes the rights of the participant or any other person that may have an interest in the award will be effective only if agreed to by that participant or other person. The administrator does not need to obtain participant or other interested party consent, however, for the adjustment or cancellation of an award pursuant to the adjustment provisions of the Incentive Plan or the modification of an award to the extent deemed necessary to comply with any applicable law, the listing requirements of any principal securities exchange or market on which our common stock is then traded, or to preserve favorable accounting or tax treatment of any award for us. The authority of the administrator to terminate or modify the Incentive Plan or awards will extend beyond the termination date of the Incentive Plan. In addition, termination of the Incentive Plan will not affect the rights of participants with respect to awards previously granted to them, and all unexpired awards will continue in force after termination of the Incentive Plan except as they may lapse or be terminated by their own terms and conditions.

Repricing and Backdating Prohibited

Neither the administrator nor any other person may decrease the exercise price for any outstanding stock option or stock appreciation right after the date of grant nor allow a participant to surrender an outstanding stock option or stock appreciation right to us as consideration for the grant of a new stock option or stock appreciation right with a lower exercise price. The administrator may not grant a stock option or stock appreciation right with a grant date that is effective prior to the date the administrator takes action to approve such award.

Foreign Participation

To assure the viability of awards granted to participants employed or residing in foreign countries, the administrator may provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy or custom. Moreover, the administrator may approve such supplements to, or amendments, restatements or alternative versions of, the Incentive Plan as it determines is necessary or appropriate for such purposes. Any such amendment, restatement or alternative versions that the administrator approves for purposes of using the Incentive Plan in a foreign country will not affect the terms of the Incentive Plan for any other country.

17

Certain Federal Income Tax Consequences

The following summarizes certain federal income tax consequences relating to the Incentive Plan. The summary is based upon the laws and regulations in effect as of the date of this proxy statement and does not purport to be a complete statement of the law in this area. Furthermore, the discussion below does not address the tax consequences of the receipt or exercise of awards under foreign, state or local tax laws, and such tax laws may not correspond to the federal income tax treatment described herein. The exact federal income tax treatment of transactions under the Incentive Plan will vary depending upon the specific facts and circumstances involved, and participants are advised to consult their personal tax advisors with regard to all consequences arising from the grant or exercise of awards and the disposition of any acquired shares.

Stock Options

The grant of a stock option under the Incentive Plan will create no income tax consequences to us or to the recipient. A participant who is granted a non-qualified stock option will generally recognize ordinary compensation income at the time of exercise in an amount equal to the excess of the fair market value of the common stock at such time over the exercise price. We will generally be entitled to a deduction in the same amount and at the same time as the participant recognizes ordinary income. Upon the participant’s subsequent disposition of the shares of common stock received with respect to such stock option, the participant will recognize a capital gain or loss (long-term or short-term, depending on the holding period) to the extent the amount realized from the sale differs from the tax basis (i.e., the fair market value of the common stock on the exercise date).

In general, a participant will recognize no income or gain as a result of the exercise of an incentive stock option, except that the alternative minimum tax may apply. Except as described below, the participant will recognize a long-term capital gain or loss on the disposition of the common stock acquired pursuant to the exercise of an incentive stock option and we will not be allowed a deduction. If the participant fails to hold the shares of common stock acquired pursuant to the exercise of an incentive stock option for at least two years from the grant date of the incentive stock option and one year from the exercise date, then the participant will recognize ordinary compensation income at the time of the disposition equal to the lesser of the gain realized on the disposition and the excess of the fair market value of the shares of common stock on the exercise date over the exercise price. We will generally be entitled to a deduction in the same amount and at the same time as the participant recognizes ordinary income. Any additional gain realized by the participant over the fair market value at the time of exercise will be treated as a capital gain.

Stock Appreciation Rights